Optimize Your Property Investment Returns With Comprehensive Full-Service and Property Administration Solutions

Real estate investment can be a gratifying venture, but browsing the complexities of residential property possession and monitoring can often be daunting. From enhancing operational effectiveness to optimizing rental revenue, these solutions supply a strategic method to enhancing home value and improving investment processes.

Benefits of Full-Service Solutions

Full-service monitoring services in genuine estate investment deal detailed support and experience to improve residential or commercial property procedures efficiently and properly. By turning over the monitoring of their genuine estate investments to professionals, residential property owners can save beneficial time and effort that would otherwise be spent on everyday procedures.

Furthermore, full-service monitoring solutions commonly come with a team of professionals that specialize in different areas such as marketing, occupant relationships, upkeep, and financial administration. This diverse capability makes sure that all facets of property management are managed with accuracy and experience. Homeowner can profit from the cumulative understanding and experience of these specialists, bring about optimized operations and increased returns on investment. In general, the comfort, know-how, and comprehensive support offered by full-service management services make them a useful possession for actual estate investors wanting to maximize their returns.

Importance of Residential Or Commercial Property Management

Reliable residential property management is a keystone of successful realty financial investments, making sure optimal performance and worth conservation. Building administration encompasses numerous tasks crucial for preserving a residential property's value, bring in tenants, and making sure lessee contentment. One crucial aspect of home management is regular repair and maintenance to keep the residential or commercial property in leading condition. By quickly attending to upkeep problems, residential property managers can prevent small problems from escalating into pricey repairs, therefore guarding the residential or commercial property's worth.

In addition, building supervisors play a vital duty in lessee procurement and retention. They are accountable for marketing the residential or commercial property, evaluating potential renters, and dealing with lease contracts. A skilled residential or commercial property manager can bring in high-grade lessees, lowering openings and turn over rates. Residential or commercial property supervisors take care of lease collection, implement lease terms, and address renter concerns promptly, cultivating positive landlord-tenant connections.

Additionally, residential or commercial property administration includes monetary management jobs such as budgeting, economic coverage, and expenditure monitoring. By effectively managing the property's funds, home managers can take full advantage of profitability and make sure a healthy and balanced roi for homeowner. To conclude, efficient property administration is essential for optimizing genuine estate financial investment returns and preserving a successful rental building.

Enhancing Property Worth

Enhancing residential property value is a critical goal genuine estate capitalists seeking to optimize their returns and enhance the long-lasting efficiency of their properties. There are several key methods that investors can utilize to improve the worth of their find more information real estate assets. One effective strategy is guaranteeing regular maintenance and upkeep to keep the residential or commercial property in optimum problem. This consists of addressing any necessary fixings quickly and carrying out restorations or upgrades to enhance the general appeal and capability of the home.

In addition, carrying out market study to stay notified about current patterns and residential property values in the area can aid financiers make educated choices regarding when and just how to boost their property value. Additionally, implementing lasting and energy-efficient features can not only attract eco-conscious renters however additionally enhance the residential or commercial property's worth in the future.

Financiers can also take into consideration boosting the aesthetic charm of the property Click This Link by purchasing landscape design, exterior enhancements, and features that can make the residential or commercial property a lot more eye-catching to potential lessees or buyers. By taking an aggressive strategy to enhancing residential or commercial property worth, genuine estate investors can optimize their returns and make certain the long-term success of their financial investments.

Streamlining Investment Processes

Implementing efficient treatments for taking care of financial investments can considerably enhance total returns and optimize efficiency genuine estate capitalists - Quinn Realty and Property Management. Streamlining investment procedures involves developing methodical operations that eliminate traffic jams, lower manual errors, and boost decision-making. One crucial element of this simplifying is the adoption of technology-driven services for property monitoring, monetary analysis, and Your Domain Name reporting

Moreover, developing clear financial investment requirements, risk evaluation techniques, and efficiency criteria can assist financiers make educated choices, alleviate dangers, and maximize opportunities much more successfully. Routinely reviewing and improving these procedures based on market fads, performance signs, and responses can guarantee that financial investment methods remain agile and receptive to altering problems. In essence, simplifying financial investment procedures is essential for making the most of returns, lessening prices, and accomplishing long-term success in realty financial investment.

Making The Most Of Rental Income

To maximize rental income in real estate investments, a critical strategy to residential property monitoring and lessee relations is critical. Understanding the neighborhood rental market fads and valuing your residential property appropriately can attract prospective lessees and ensure a stable stream of revenue.

Another approach to boost rental revenue is by providing features or services that validate greater rental prices. This might consist of providing on-site washing facilities, vehicle parking spaces, or access to recreational areas. By boosting the worth proposition of your home, you can validate billing greater rents and possibly increase your rental revenue.

Furthermore, executing an aggressive lessee testing process can help identify reputable renters that are most likely to pay rent on time and take good care of the property. This can decrease the risk of rental revenue loss due to home damage or non-payment of lease. By concentrating on efficient home management techniques and cultivating positive lessee relationships, actual estate capitalists can maximize their rental income and overall financial investment returns.

Conclusion

To conclude, using thorough full-service and building administration services can substantially boost property financial investment returns. By delegating professionals to deal with various facets of residential property ownership, capitalists can focus on optimizing rental income and increasing building value. Improving investment processes through these services can bring about a lot more effective and successful realty endeavors. In general, including full-service solutions and building monitoring is important for making best use of returns on property financial investments.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Bradley Pierce Then & Now!

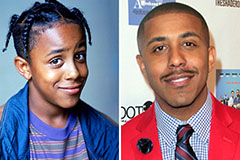

Bradley Pierce Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!